TAG Consulting specializes in providing specialized VAT consultancy services to organizations. With in-depth expertise in VAT laws and regulations, our experienced team delivers customized solutions to help businesses achieve compliance, develop strategic VAT planning, and optimize their VAT processes for maximum efficiency.

Book A Free ConsultationExpert assistance to guide VAT registration, ensuring accurate setup and support to meet regulatory requirements effectively.

Support for accurate preparation and timely filing of VAT returns to ensure full compliance with tax regulations.

Detailed audits to identify risks, address compliance gaps, and help businesses avoid penalties while maintaining proper regulatory alignment.

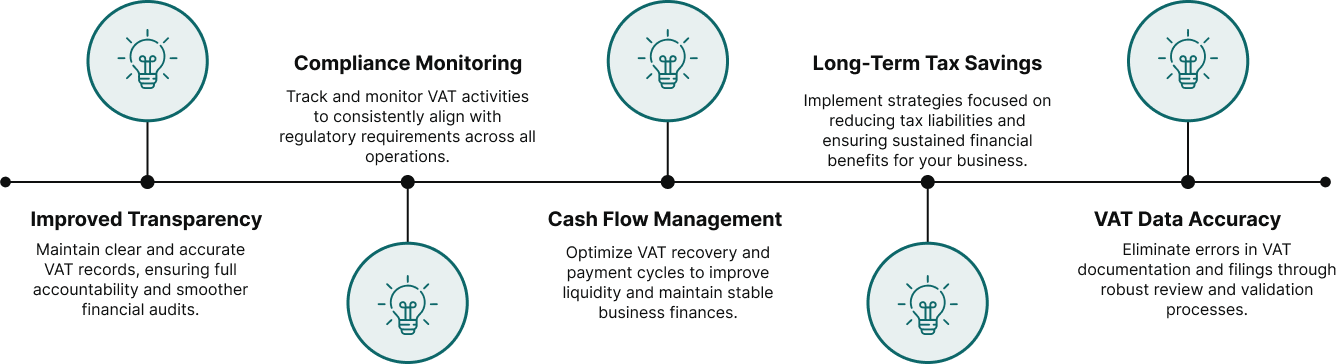

Plans to reduce VAT liabilities, improve cash flow, and boost VAT recovery, customized to specific business needs.

Review and improvement of VAT processes to cut costs, increase efficiency, and ensure smoother operations in tax management.

Continuous expert guidance to address VAT-related queries, adapt to updated regulations, and maintain effective compliance practices.

We help you uncover opportunities to reduce VAT liabilities through effective strategic planning.

With deep expertise across multiple sectors, we customize VAT solutions to meet your industry needs.

Providing high-quality VAT advisory services at competitive rates tailored to fit your business budget.

Offering continuous expert guidance to address VAT queries, adapt to changes, and ensure compliance effectively.

We combine expert knowledge, personalized strategies, and proactive solutions to help businesses meet VAT compliance requirements, improve processes, and reduce liabilities while providing efficient and effective management of all VAT-related tasks.

There is no way to avoid paying the Value-Added Tax (VAT) when conducting business in Pakistan. Companies are considering how

Financial threats, changing rules, and hidden operational gaps are all sources of uncertainty that business owners face on a daily

Starting a financial services business now could be your way to success in a field that is growing with potential.

Risk exists everywhere, from cyber attacks to altering legislation, and neglecting it can have serious consequences for your business. IRM

Managing risk isn’t just a smart move; it’s essential. Many different types of hazards can disrupt operations and damage a

Training and development is an organization’s ongoing strategy to raise the level of expertise among its employees. Improvements in long-term

Success nowadays includes more than just having exceptional products or services. It requires that every aspect of your organization functions

Customer service, bookkeeping, data entry, and many other critical duties are handled by BPO firms for other businesses. Business process

Your success is highly dependent on your efficiency and adaptability. Businesses all across the world are taking use of a

"The tailored financial advisory services offered by TAG have greatly improved our decision-making processes. Their expertise in VAT consultancy and compliance has been a critical factor in our operational success."

"TAG’s business assurance services have been instrumental in improving our risk management framework. Their deep industry knowledge and ability to offer practical solutions have elevated our operational standards."

"TAG’s ability to provide tailored accounting solutions streamlined our processes, allowing us to focus on key growth areas. Their support has been invaluable to our financial management team."

"TAG Consulting’s comprehensive audit services have helped us maintain compliance with stringent regulations while enhancing operational efficiency. Their team’s professionalism and attention to detail are truly commendable."

"TAG’s expertise in financial and operational reporting has been an asset to our operations. Their ability to provide detailed insights while ensuring accuracy in accounting processes has significantly improved our financial transparency."

"The staff secondment services provided by TAG were exactly what we needed to support our Accounting and Finance department. Their qualified professionals seamlessly integrated into our team, helping us meet critical project deadlines with ease."

"TAG’s work in re-evaluating and upgrading our budgeting models provided us with enhanced clarity and efficiency. Their efforts in automating our accounting systems were invaluable, streamlining our operations and preparing us for future growth."

"TAG’s re-evaluation of our budgeting models and their upgrade of our accounting systems were a game changer. They provided a holistic view of our business, helping us to strengthen our offshore market share and improve internal operations."

"TAG's financial feasibility study for our agricultural investment project in Pakistan was critical to our decision-making process. Their financial modeling and projections gave us a clear understanding of the potential outcomes, making it easier to move forward with confidence."

"TAG’s recruitment support was impeccable. From advertising to shortlisting and interviewing, they provided top-tier candidates that perfectly matched our requirements. Their hands-on approach ensured we secured the best talent for our needs."

"The expertise of TAG’s team, particularly in staffing our Finance & Accounting division during critical times, was instrumental. They perfectly complemented our knowledge base and provided much-needed support for the ERP implementation. Their professional support has been invaluable for our operations."

TAG’s accounting and bookkeeping outsourcing services were nothing short of exceptional. Their attention to detail, combined with their knowledge of US-GAAP and IFRS, ensured that our quarterly and annual financial statements were accurate and timely. They’re a valuable partner for any accounting needs."

"TAG's professional staff deputation was key in balancing our Finance & Accounting division’s workload. Their expertise, especially in SOX compliance, ensured a smooth and effective implementation process, exceeding our expectations."

"TAG’s commitment to excellence was evident in their work on our HR and Operations Manuals. Their attention to detail ensured alignment with our corporate policies, setting the foundation for improved efficiency across all our divisions. We were impressed with their thorough evaluation of our Environmental Services Division as well, which provided crucial insights for operational improvements."

"TAG Consulting demonstrated exceptional professionalism in compiling our financial statements across various entities, ensuring timely delivery for external audits. Their deep understanding of both local and international portfolios made the process seamless and highly efficient. We highly recommend their services for financial management needs."

Subscribe to our newsletter and be the first to receive the latest industry trends, business tips, and exclusive updates from TAG Consulting. Empower your business with valuable knowledge and stay ahead in your industry.